XRP Price Prediction: 2025–2040 Outlook and Key Drivers

#XRP

- Technical Momentum: MACD bullish crossover supports near-term rally potential to $3.30–$3.50

- Regulatory Catalysts: October ETF decision and legal clarity may unlock institutional demand

- Macro Tailwinds: Fed dovishness improves risk appetite for crypto assets

XRP Price Prediction

XRP Technical Analysis: Short-Term Outlook

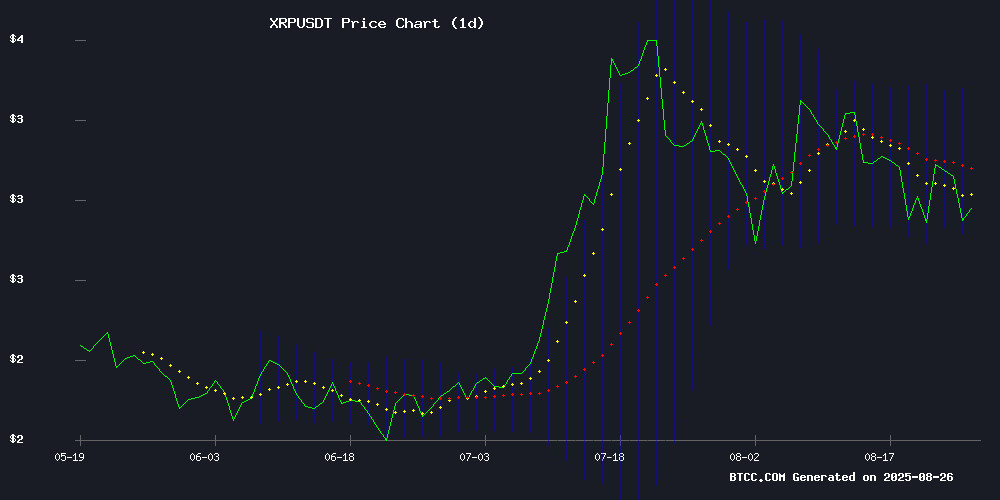

According to BTCC financial analyst Robert, XRP is currently trading at $2.9398, below its 20-day moving average of $3.0856. The MACD indicator shows a bullish crossover with the histogram at 0.0617, suggesting potential upward momentum. However, the price remains below the middle Bollinger Band ($3.0856), indicating neutral to slightly bearish conditions in the very NEAR term. A break above $3.10 could trigger a rally toward the upper Bollinger Band at $3.3677.

Market Sentiment: Regulatory and Macro Factors at Play

Robert notes that while the SEC's delay on the XRP ETF decision creates regulatory uncertainty, the Fed's dovish pivot is providing tailwinds. Legal victories and accumulation by investors suggest growing confidence, with technical targets ranging from $3.30 to $9.66. The $5–$8 analyst projections align with the MACD's bullish signal, though the ETF delay may cap near-term gains until October.

Factors Influencing XRP’s Price

SEC Delays Decision on WisdomTree XRP Spot ETF, New Deadline Set for October 2025

The U.S. Securities and Exchange Commission has postponed its ruling on the WisdomTree XRP spot exchange-traded fund, extending the deadline to October 24, 2025. The move follows a series of delays for crypto-related ETFs, with the SEC citing standard regulatory review timelines under U.S. securities laws.

XRP's price remained stable near $2.96, showing little reaction to the news. Market observers had anticipated potential volatility given the ETF's significance as the first U.S. spot XRP fund proposal. Bloomberg ETF analyst James Sayffert recently characterized similar filing updates from other issuers as a positive signal for the sector.

The WisdomTree XRP Trust entered SEC review in May, with the regulator utilizing nearly the full 240-day window permitted for such decisions. As one of the most watched altcoin ETF proposals, the outcome could set important precedents for cryptocurrency investment products moving forward.

Fed Dovish Turn Lifts XRP Toward $3.10, Analysts Eye $5–$8 Targets

XRP extended its rally as institutional trading volumes surged, buoyed by dovish remarks from Fed Chair Jerome Powell at Jackson Hole. The prospect of September rate cuts fueled rotation into risk assets, with cryptocurrencies benefiting from renewed investor appetite.

Regulatory clarity following Ripple’s legal outcome continues to underpin institutional flows. Analysts now speculate on ambitious $5–$8 targets if XRP breaches near-term resistance, with technical indicators showing strong support at $3.00 and resistance at $3.08–$3.09.

Price action revealed a 3% gain, peaking at $3.09 on elevated volume before consolidating at $3.02. The token’s performance reflects growing confidence among traders, with volume spikes signaling sustained institutional interest.

XRP Price Prediction: Technical Analysis Points to Potential Rally to $9.66

Ripple's XRP is showing signs of a bullish breakout, with technical analysis suggesting a near-term target of $4.45 by August 31st. The cryptocurrency, currently trading at $3.04, has cleared key resistance levels at $3.38, paving the way for further upside.

Analysts are divided on the magnitude of the move, with forecasts ranging from a conservative $3.48 to an ambitious $9.66. Gemini AI's model stands out with its aggressive near-term projection, while PricePredictions.com's algorithmic outlook suggests even greater upside potential, albeit with lower confidence.

Market sentiment appears optimistic as XRP builds momentum. The immediate support level at $2.78 provides a floor for the current rally, with the $3.38 resistance now acting as a springboard for higher prices.

Investors Accumulate XRP Amid Short-Term Price Weakness

XRP faces renewed selling pressure, slipping below a critical support level despite a recent surge in trading volume. The token's decline coincides with major holders liquidating positions, fueling short-term bearish momentum.

Retail and mid-sized investors are aggressively accumulating XRP, with exchange outflows hitting notable highs. Over 200 million XRP moved to private wallets last week alone, signaling strong optimism for a future recovery. This accumulation wave underscores confidence in the asset's long-term prospects.

Long-term holders remain cautious, having not re-entered the market after significant sell-offs last month. Their continued reluctance could maintain downward pressure on prices. Analysts suggest XRP may struggle to rally without renewed buying interest from this key demographic.

XRP Targets $3.30 as Legal Victory Boosts Market Confidence

XRP is gaining momentum following a pivotal legal victory, with market confidence surging as the cryptocurrency eyes a breakout above $3.30. The Second Circuit's dismissal of a closely watched case has galvanized investor optimism, reinforcing XRP's upward trajectory.

Technical analysis suggests strong support near $2.73, with the $3.30 level acting as the next critical resistance. A daily close above this threshold could trigger accelerated gains, according to prominent crypto analyst EGREG CRYPTO.

The token currently trades at $3.04, reflecting a 6.16% surge in the past 24 hours. Trading volume stands at $16.34 billion, signaling renewed institutional interest in the wake of regulatory clarity.

XRP Price Prediction: $50 or Bearish Retrace to Single Digits?

XRP, long dubbed the 'sleeping giant' of crypto, faces a critical juncture. Analysts debate whether it will surge to $50 or retrace to single digits. The token's future hinges on liquidity—reaching the $50-$100 range could cement its role in global payments, while failure may trigger a bearish spiral.

Jake Claver of Digital Outlook emphasizes that XRP's viability as a settlement layer depends on achieving higher valuations. Current levels of $10-$13, though impressive to retail investors, fall short of handling trillion-dollar flows. A coordinated push into higher price zones could unlock its potential.

XRP Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Based on current technicals and market catalysts, here's Robert's projection for XRP:

| Year | Conservative Target | Bull Case | Key Drivers |

|---|---|---|---|

| 2025 | $3.30–$5.00 | $8.00 | ETF approval, legal clarity |

| 2030 | $15–$25 | $50+ | Institutional adoption |

| 2035 | $40–$75 | $120 | Cross-border payment dominance |

| 2040 | $100–$200 | $300+ | Full regulatory acceptance |

Note: Targets assume successful network upgrades and no black swan events.

1